關鍵字:DRAM

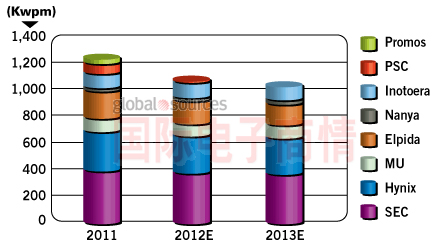

2011-2013年DRAM市場供需變化

SOURCE: IDC, Gartner, Barclays Research estimates

新市場的特性

Barclays預計,基于寡頭市場和產業遷移仍存在難點,DRAM市場將經歷一個風平浪靜且漫長的復蘇階段。而到2013年,服務器/移動設備取代PC成為需求增長點,將帶給DRAM產業一個更好的平穩增長模式。

在爾必達破產并解決了資產處置問題后,DRAM產業將越來越像NAND產業,在供求和定價上也將變得愈加理性。Barclays 認為,爾必達遭遇滑鐵盧的境遇就如2009年上半年的SK海力士。美光對爾必達的極具戰略性的收購將促使DRAM產業更好地復蘇。Barclays還聲稱,促使市場復蘇最關鍵的還是瑞晶(全球7%產能)和爾必達廣島廠(全球10%產能)的產能轉向非DRAM制造。

2011-2013年全球DRAM晶圓產能分析(基于12英寸晶圓)

SOURCE: IDC, Barclays Research estimates

如何產生影響

DRAM產業的波動周期將變窄,因為越來越多的需求是來自于專業領域:庫存趨于穩定,產品定制化。而且,寡頭時代的頂級廠商也能以更具前瞻性的眼光來控制供應量,保持市場供應的穩定。另外,經過長時間的行業不景氣后,大浪淘沙下,存活下來的DRAM廠家是少且優的,這也意味著行業的波動趨向平穩。

在需求方面,即將推出的三星Galaxy S III LTE版將配置2GB DRAM(在Galaxy S III 3G版中僅為1GB),蘋果iPhone 5將配置1GB DRAM(iPhone 4S僅為512MB),這將顯著地增加2012年第三季度對移動DRAM的需求,并使得產業供應趨向緊張。同時,僅此兩種產品的單設備DRAM配置容量增長已相當于額外增加了1000萬顆PC DRAM需求,近乎2012年第二季PC DRAM需求的5%。而在服務器領域,單設備DRAM配置容量增長也相當于200萬顆,近乎1%的PC需求。

Global DRAM recovery: Is DRAM becoming NAND-like?

The dynamic random access memory (DRAM) recovery is sustainable into 2013, say Barclays Capital analysts. DRAM benefits from a supply discipline that was bolstered by oligopoly/DRAM consolidation and the Elpida bankruptcy; robust demand growth from non-PC applications (server/mobile DRAM bit demand to exceed PC for the first time in 2013E); and potential for additional positives related to Elpida (Hiroshima/Rexchip converted to non-DRAM).

[Figure 1. DRAM supply/demand. SOURCE: IDC, Gartner, Barclays Research estimates.]

Figure 1. DRAM supply/demand. SOURCE: IDC, Gartner, Barclays Research estimates.

What is different from previous cycles? Barclays expects a less dynamic but longer-lived recovery given the oligopoly situation and technological difficulties in geometry migration; and server/mobile DRAM becoming the demand driver, supplanting PC, in 2013, offering a better growth profile and much less volatility.

The DRAM industry is becoming increasingly similar to the NAND industry, and will see an even more rational supply/pricing environment, once Elpida's bankruptcy and asset sale are resolved. Barclays sees the Elpida situation as similar to SK Hynix's stumble in NAND in H1 2009. Micron's strategic choice post acquisition of Elpida could trigger an even better DRAM recovery. The best case scenario would be the disposal of Rexchip (7% of global capacity) and some of Hiroshima fab (10%) migrating to non-DRAM manufacturing, Barclays asserts. Also read: DRAM partially recovers thanks to Elpida bankruptcy

[Figure 2. Global DRAM wafer capacity status. Note: Based on 12-inch wafers. SOURCE: IDC, Barclays Research estimates]

Figure 2. Global DRAM wafer capacity status. Note: Based on 12-inch wafers. SOURCE: IDC, Barclays Research estimates

What does this mean for share price performance? The peak and the trough of the DRAM cycle will narrow as more demand comes from specialty DRAM, which has less inventory swing, being a more customized product; and more proactive supply control by top-tier manufacturers after becoming an oligopoly. Following a prolonged industry downturn, there are currently fewer players in DRAM market, reducing volatility.

The launch of Samsung’s Galaxy S III LTE, which may adopt 2GB DRAM (vs 1GB of 3G Galaxy S III) and Apple’s iPhone 5, which may adopt 1GB DRAM (vs 512MB iPhone 4S) will significantly boost mobile DRAM demand from Q3 2012, driving tight supply. The impact of DRAM content per box growth for just these two models offers the equivalent of 10 million units of additional PC demand (5% of total PC demand) in H2 2012, Barclays estimates. In servers, an incremental increase in content per server should offer the equivalent of 2 million PCs (1% of total PC demand).

移動設備訪問

移動設備訪問